Hiring the right people, then properly motivating and managing them, can make or break most businesses.

Your employees should be your best assets, but they can create significant liabilities if you don’t implement sound employment practices.

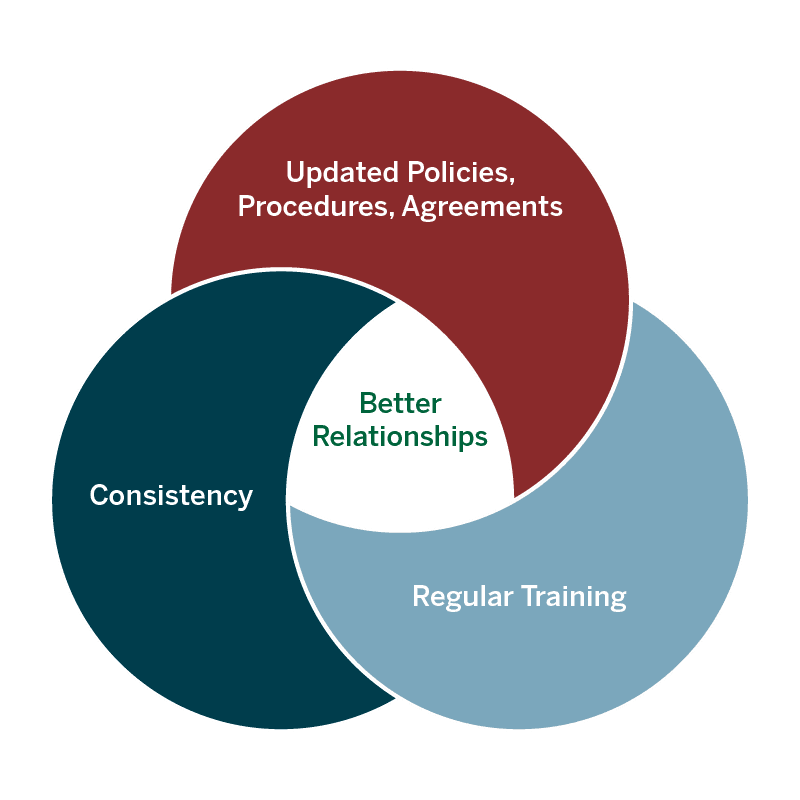

We’re here to help. At Venn Law group, we work with our clients to tackle their employment concerns by focusing on three key areas:

- Policies and procedures

- Regular training

- Consistency in the application of those policies to all employees.

By addressing these three key areas, businesses will reap the benefits of better employer/employee relationships, reduce overall employee discipline issues (as well as any legal issues), and create a better environment for everyone at work.

Policies and Procedures

It's about setting expectations.

As an employer, state and federal laws require specific policies and procedures for your employees. These policies and procedures are designed to protect the value of your business, your customer relations, as well as protect your employees. From employee handbooks to employment agreements and non-compete agreements, these policies should be carefully drafted and reviewed regularly.

Training

What they don’t know can hurt you.

Publishing policies is not enough. Employees need consistent training programs on a variety of topics, including, but not limited to, on-boarding, benefits, corporate culture, conflict resolution, time management, and product and service training. Additionally, senior employees with management responsibilities also need guidance on how to lead and react to employment issues. Untrained employees often make work situations worse and create additional and unnecessary liabilities for employers.

Consistency

Following through is a key indicator of success.

Setting expectations and providing training make for a great start, but employers need to apply the policies reliably. Many legal claims by employees can be avoided by ensuring consistent treatment among all employees.

Owners, managers, human resources executives, employees, and service providers all need an advisor that can see the entire situation, both from a legal and a business perspective. At Venn law Group, we offer practical advice and solutions to employers, employees, and other service providers to deal with the following major topics:

- Hiring Policies and Procedures

- Restrictive Covenants (Non-Competition, Non-Solicitation and Other Provisions)

- Employee Incentives and Compensation

- Employment Policies and Procedures

- Regulatory Compliance

- Employer Liability Issues

- Employee Misconduct Investigations

- Employment “Best Practices”

- Employee Termination Issues

- Severance Agreements

- Department of Labor Actions and Investigations

- EEOC Actions and Investigations

- Employment Security Commission Actions and Investigations

Helpful Links

FAQs

Yes, non-competition agreements are enforceable in most states if drafted and used properly. However, each state has different rules, and such rules can get very complicated. Be sure to work with an attorney to prepare such agreements for your employees. Additionally, there are different types of “non-competes,” such as agreements that only protect your existing customers instead of preventing the employees from competing with you at all. These other types of agreements can be much easier to enforce as well and are worth investigating.

Yes, but only upon particular circumstances. In North Carolina, you can generally only deduct money from an employee’s paycheck with their prior written consent or after filing a report with the police regarding a suspected theft. Other states have similar conditions designed to protect employees from unfair deductions. If you suspect an employee of stealing, damaging, or losing property, or otherwise believe you should deduct monies from their pay, be sure to examine the rules for making those deductions before taking that money.

When providing paid time off (PTO) to employees, it is critical to have a written policy that is easy for everyone to understand how time is earned, used, and forfeited. Be precise on when and how employees earn PTO so that they know what to expect and to avoid confusion. Also, detail the approval process for their use of PTO in advance or any restrictions on how much time they use at any one time. Lastly, define the limits on the PTO they can accumulate at any one time and whether it gets paid out to them upon the termination of their employment. Unfortunately, many employers neglect this last requirement and incur significant costs upon the termination or retirement of long-term employees that rarely used PTO or wind up having to pay PTO out to employees they fired for misconduct.